In search of an economic and military foothold in the Middle East, China recently signed a 25-year mega deal with Iran, but while that deal has been described as a "win-win" by both regimes, observers say it would be wise for Iran not to pin any hopes of economic salvation on any such agreements that fall under Beijing's Belt and Road Initiative (BRI).

Any deal between China and Iran is premised on a major imbalance of power: Iran needs China but not vice versa.

China is Iran's top trading partner. The CIA's World Factbook states that 48% of Tehran's exports go to Beijing.

But China prioritises other Middle Eastern countries over Iran, since international sanctions complicate trade with Tehran.

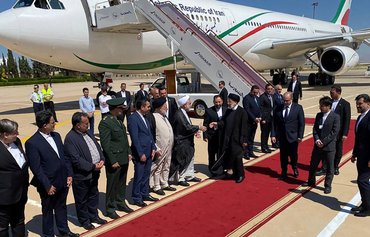

![Chinese Foreign Minister Wang Yi visits Iranian President Hassan Rouhani in Tehran March 27. [Iranian presidential office]](/cnmi_di/images/2021/09/08/31589-161683177382146000__1_-600_384.jpg)

Chinese Foreign Minister Wang Yi visits Iranian President Hassan Rouhani in Tehran March 27. [Iranian presidential office]

![Iranian workers harvest romaine lettuce at a farm in Karaj, Alborz province, April 30. Amid the scarcity of pesticides and other agricultural necessities, farmers are facing poor harvests, causing produce prices to increase. Observers doubt the pact with China will turn the Iranian economy around. [Atta Kenare/AFP]](/cnmi_di/images/2021/09/08/31590-000_9948fw-3-600_384.jpg)

Iranian workers harvest romaine lettuce at a farm in Karaj, Alborz province, April 30. Amid the scarcity of pesticides and other agricultural necessities, farmers are facing poor harvests, causing produce prices to increase. Observers doubt the pact with China will turn the Iranian economy around. [Atta Kenare/AFP]

"Since 2005, the average Chinese investment in Iran never exceeded $1.8 billion a year, which is markedly less than its investments in Saudi Arabia and the UAE," the Carnegie Endowment for International Peace said in August.

The official 2020 China Statistical Yearbook lists the top 18 exporters to the country. Saudi Arabia and Kuwait appear on that list, while Iran is nowhere to be seen.

As for oil, Iran supplies only 3% of China's oil imports, The Diplomat reported in March, while Saudi Arabia, Russia, Iraq and Brazil rank as Beijing's top oil suppliers.

The Aggregates Business news site last November described some top BRI projects in the Middle East -- none pertaining to Iran: "At a meeting of the China-Arab States Co-operation Forum (CASCF) in Beijing in 2018, China pledged $23 billion in loans and development aid to the region. The meeting identified the UAE's Khalifa Port, Oman's Duqm, Saudi Arabia's Jizan, and Egypt's Port Said and Ain Sokhna as key projects that China will develop in association with the BRI in the Middle East."

"Chinese contractors are also involved in major infrastructure construction contracts in Qatar, including the $25 billion expansion plans for Hamad International Airport (HIA)."

Indebted, isolated, cornered

The $400 billion "strategic co-operation pact" deal signed in March envisions China investing in Iran over 25 years in exchange for a steady supply of oil, likely offered at a lower sale price, according to details that the two sides publicly announced.

The agreement also calls for joint military training and exercises, joint research, arms development and intelligence-sharing.

From Beijing's perspective, "the point of the deal is for China to gain a foothold in Iran, particularly on the islands of Jask and Kish in the Persian Gulf", said a former Iranian navy analyst who spoke on condition of anonymity.

Enhanced Chinese military co-operation with Iran resulting from the deal "is a foregone conclusion", he said.

But the secrecy surrounding the deal has aroused major concern among many Iranians who do not trust China and have said the Iranian regime is "selling the country to China for next to nothing".

Meanwhile, the pact also puts China in a vulnerable position as it opens the door to punishing US sanctions.

Once the pact is implemented, a weak, internationally isolated and cornered Iranian regime -- having made backbreaking economic commitments -- will be at the mercy of an emboldened and assertive Chinese regime.

Many observers fear that Beijing will offer unaffordable loans to Iran, similar to what it has done in the past -- imposing burdensome contracts on vulnerable countries -- to demand even more concessions from Iran, possibly military concessions.

China already has constructed a series of ports along the Indian Ocean, creating a necklace of refuelling and resupply stations from the South China Sea to the Suez Canal, and with the deal, focus will now shift to the Iranian ports of Jask and Chabahar.

These ports are commercial, but the agreement could make way for China's navy to extend and expand its presence in the region through them.

Deal gives more power to IRGC

Through the agreement, China is making efforts to cultivate leverage, and the deal with Iran is a prime opportunity: a suitable means to the end that Beijing seeks.

But what the deal also does is provide indirect support to Iran's Islamic Revolutionary Guard Corps (IRGC) -- a designated terrorist organisation -- and its overseas arm, the Quds Force (IRGC-QF).

A large portion of the Islamic Republic's annual budget goes to fund the IRGC and its activities and allies abroad.

The IRGC-QF, which identifies its objective as "exporting the Iranian revolution", has been exporting terror in the region through arming its proxy militias in Iraq, Syria, Lebanon, Bahrain, Yemen and Afghanistan.

These proxies routinely destabilise the region through attacks on strategic targets with rockets, missiles and drones.

The ongoing disruptive actions of the IRGC, while impeding Iran's development and recovery, would also pose a major obstacle to the economic and military plans of China.

A case in point is the September 2019 US sanctions on two units of China's largest transportation network, China Ocean Shipping Co. (COSCO), for being complicit in circumventing sanctions on Iran.

The embargo on COSCO immediately drove up the price of oil shipments in Asia and increased overall costs by some 30%.

Sanctions on Chinese companies or citizens over their Iran-related activities would make China lose significant segments of its global markets, which are estimated to yield several times the potential profit of investing in Iran.

![The national flags of Saudi Arabia and China are displayed from a road lamp at Tiananmen square in Beijing. [WANG Zhao / AFP]](/cnmi_di/images/2021/09/08/31588-000_1do7fp__1_-600_384.jpg)