As security improves in the Ninawa province city of Mosul, banks and money transfer companies are seeking official approval to resume business.

The once pervasive threat that the "Islamic State of Iraq and Syria" (ISIS) might infiltrate the province's banking sector has been eliminated, local officials said.

Six years ago, Iraq's Central Bank suspended the operations of all Ninawa banks and money transfer companies, amid concerns that the extremist group might use them to obtain funds to support its terrorist activity.

Since then, transferring funds to and from Mosul for business purposes has been an ordeal, electrical appliance shop owner Sadiq al-Juhaishi told Diyaruna.

The suspension of banking services has made it difficult to transfer funds to businesses in Baghdad and abroad to purchase goods or pay bills, he said.

As a work-around measure, he said, businesses have been transferring and receiving larger sums of money via banks or money transfer companies based in neighbouring Erbil province.

These serve as conduits for the transfer of funds to Baghdad or abroad "despite the heavy risks associated with transferring large amounts of money between both provinces", he said.

"This is a concern for all wholesale and retail businesses in Ninawa," he said, adding that now the province is stable and secure, this issue must be resolved.

Negative effects

In addition to its impact on commerce, the disruption of banking services in Ninawa has affected the industrial and agriculture sectors, said Abdullah Khalil, director of the Association of Banking Companies in Ninawa province.

It also has affected the movement of money throughout Iraq, he told Diyaruna.

Local and international companies working on reconstruction in Mosul have suffered the impact as well, he said, particularly as the work of these companies requires money transfers to and from the province.

The continued suspension of banking operations in the province "will only add to the economic deterioration that was caused by ISIS", he said, calling on the Central Bank to permit these entities to resume business.

According to Khalil, it is unlikely that ISIS is now in a position to exploit these financial institutions, as its remnants are no longer able to move around freely.

Security co-ordination

Granting banking entities permission to resume business in Mosul is a joint decision, made between the Central Bank and security agencies in the province.

"The bank has drafted a list of companies that are licensed to work in the province after the exclusion of all companies involved in money laundering and terrorist financing," Central Bank spokesman Aysar Jabbar told Diyaruna.

The bank has notified security authorities in Ninawa of the names of these institutions, he said, noting that the final authorisation to resume business will remain with the security authorities.

The Central Bank has been hugely successful in identifying companies suspected of irregular dealings, suspending their operations and depriving them of the chance to move their money around to rogue entities, he noted.

He called on the security authorities in Ninawa to give the green light to licensed banking companies to operate, which will enable them to generate revenues that would boost the economy of the province.

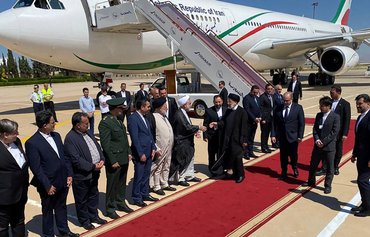

![This Al-Rafidain Bank branch in eastern Mosul's al-Hamdaniya district reopened in 2017, a year after the completion of rehabilitation work. [Photo courtesy of Al-Rafidain Bank]](/cnmi_di/images/2020/01/16/21890-Iraq-Rafidain-bank-600_384.jpg)