To circumvent the international blockade on its financial transactions, the "Islamic State of Iraq and Syria" (ISIS) has been using money transfer shops to smuggle funds out of Syria, experts tell Diyaruna.

To do this, the group has exploited a vulnerable segment of the population -- Syrians who rely on remittances from abroad as a primary source of income.

When he operated a money transfer and currency exchange shop in Deir Ezzor, business owner Hussein Saffar told Diyaruna, he faced so much pressure from ISIS that he was eventually forced to close his shop.

Saffar, who now owns a money transfer and currency exchange shop in Idlib city, said he had been prohibited from taking action on any financial remittance without first checking with the group’s "financial bureau".

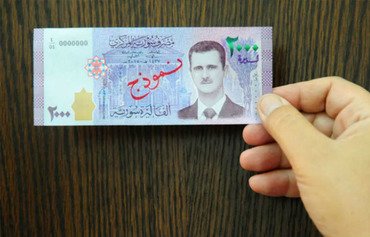

ISIS then banned his shop from dispensing remittances in foreign currency, he said, particularly US dollars and Euros.

Later, he added, ISIS sent around a circular instructing all workers in the private financial sector to pay out remittances in Syrian pounds.

A subsequent circular instructed them to pay them out in ISIS's currency and to hand over the foreign currency directly to the group on a daily basis, he said.

By paying out remittances in the Syrian pound or in its own currency, ISIS can retain the more valuable foreign currency for its own use, he said.

"The group imposed and collected a tax on every transfer twice, upon issue and upon receipt, and the rate varied depending on the value of the transfer and the source or destination country, and sometimes reached 15%," Saffar said.

International crackdown on ISIS financing

In recent months, there has been a noticeable change, Saffar said.

For the past three months, the only remittances coming to Deir Ezzor are those issued by licensed money transfer companies in foreign countries, he said.

"All random remittances that used to reach residents have stopped altogether," he said, adding that workers in the money exchange sector attribute this shift to the international crackdown on ISIS financing.

"Remittances have become an important lifeline for Syrians," media activist and Deir Ezzor native Abu Rahman al-Deiri told Diyaruna.

"Jobs are non-existent, and Syrian workers and refugees abroad have become the main source of income for Syrians inside the country," he explained.

Financial conditions in ISIS-controlled areas are the worst, so remittances are critical to families in order to survive, he said.

Though financial transfers are subject to strict controls, many Syrians living abroad have been able to send money to their relatives back home through non-official companies and dealers, he said.

Some of these operations are complicit with ISIS, while others may be vulnerable to exploitation.

"By imposing the use of its currency in transactions, ISIS preserves its hard currency and even increases its profit from the exchange transactions," he said.

Coalition strikes target collaborators

Money exchange companies in Syria that collaborate with ISIS have been a target of coalition airstrikes, Syrian lawyer Bashir al-Bassam told Diyaruna.

ISIS collaborator Fawaz Mohammed Jubair al-Rawi, who operated the multi-branch Hanifa Exchange Company, was killed in a June 16th airstrike in Albu Kamal.

ISIS financial facilitator and international money launderer Samer Idris was killed in a June 7th airstrike near Mayadeen, Syria, according to a US Department of Defense statement.

The group's senior leadership had entrusted him with moving funds across borders to pay for external terror attacks, the statement said.

"The effort to prevent ISIS from benefitting from remittances also includes the distribution of security bulletins listing the names of companies and people who work in this field and are under suspicion," al-Bassam said.

Raids have been conducted on unlicensed operators in a number of countries, he added, and those engaging in suspicious activities have been suspended.

Restrictions on international transfers

"Most countries are imposing strict restrictions on the issue of money transfer," al-Bassam said, adding that with a spotlight on these activities, "ISIS was forced to find alternative ways" to conduct its financial transactions.

To work around these restrictions, ISIS sent operatives with ties to Syria abroad to form networks of individuals willing to engage in the money exchange trade.

These operatives are either fully loyal to the group, or have been entrapped by the group as a result of their financial situations, he explained.

There are some who transfer money to and from Syria without knowing the identity of the owner of the money, al-Bassam said.

Most of these remittances are small sums of less than $500, he said, and typically fall within the $100 to $300 range.

"They are monthly remittances to families with relatives abroad," he said.

Some may think these amounts are small and do not constitute a threat, he said, but the danger lies not in the amount of a single transfer but rather in the cumulative amount of these transfers.

Collectively, these could reach hundreds of thousands of dollars a month, he said.

![Money changers await customers in this currency exchange and money transfer shop in rural Deir Ezzor. Business owners face severe consequences if they collaborate with the 'Islamic State of Iraq and Syria'. [Photo courtesy of Mohammed al-Abdullah]](/cnmi_di/images/2017/09/29/9784-Syria-money-exchange-600_384.jpg)