The flow of money supporting terrorist activity in Iraq has significantly declined, along with money laundering, while the transfer of cash of unknown source and destination has stopped altogether, Central Bank of Iraq (CBI) officials said.

These successes are due to new internal regulatory measures and international agreements designed to increase the monitoring of funds and address weaknesses in the Iraqi banking system, they told Diyaruna.

Over the last few years, terror groups have exploited the Iraqi banking system, attempting to launder and smuggle money to support in-country terrorist activity before the CBI carries out monitoring procedures, they said.

"The CBI, as a supervisory financial institution, is concerned with Iraq’s monetary financial policy and recently has worked to implement legal procedures to monitor the movement of funds and stop any suspicious activity," CBI spokesman Aysar Jabbar told Diyaruna.

Monitoring of funds is done by tracking money coming into Iraq and the movement of funds within the country, he explained.

"The first channel has been largely brought under control, thanks to international conventions on fighting terror group activity and co-operation with regard to draining the terrorists’ resources and curbing money laundering," he said.

The CBI and its Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) Office have signed an agreement with the US Treasury to monitor the movement of funds in co-operation with Iraqi banks and financial companies, he said.

In mid-December, the US Treasury announced financial sanctions against several money exchanges in Iraq and Syria and an individual financier , all accused of funneling cash to the "Islamic State of Iraq and the Levant" (ISIL), AFP reported.

The sanctioned entities include Selselat al-Thahab Money Exchange Company of Iraq, which allegedly processed money transfers for a known ISIL financier and conducted more than 100 transfers into ISIL territory, the Treasury said.

Tightened internal monitoring

"With regard to money flows within Iraq, that occurs using internal hand-written orders of payment based on primitive systems," Jabbar said.

Despite these challenges, he said, the CBI has developed special monitoring and validation controls that can work with the existing systems.

The CBI has ordered all financial services offices and money transfer companies in the country to open files for every client and every money payment order, he said. These must include a copy of the original documents, which detail the sender's identity, the purpose of the transfer, and the receiving party.

"The relevant bodies review all those files and check the money payment’s amount, reason for transfer, and whether the client has disclosed the nature of his payment," he said.

In December alone, the CBI stopped 102 financial services companies from transferring funds within Iraq without adhering to rules and standards and without validating the parties to whom the money had been transferred, he said.

These monitoring procedures have not stopped terrorism financing in Iraq completely, Jabbar said, but they have made significant progress in this area, stopping around 80% of the unsanctioned flow of funds and money laundering.

Key part of the battle

Curbing money laundering crimes and stopping money transfer companies that support ISIL is as important as fighting the group on the battlefield, said Iraqi MP Najiba Najib, who serves on the parliamentary economic committee.

"The parliamentary economic committee, once the parliament is back from recess, will include in its agenda the issue of money laundering and the ways to stop money transfers in support of ISIL," she told Diyaruna.

Choking off ISIL’s financial resources complements the military activity that has targeted its resources on the ground, such as its sale of oil and collection of protection money, economist Bassem Antoine told Diyaruna.

"The Mosul liberation battle alone has caused ISIL to lose many oil wells, which have been a significant part of its economic mainstay through smuggling oil out of Iraq and benefitting from the revenues," he said.

Since ISIL has been contained in specific locations in Mosul and al-Hawija, with all access routes to other cities and towns cut off, it is no longer able to smuggle oil or exercise control over trafficking routes.

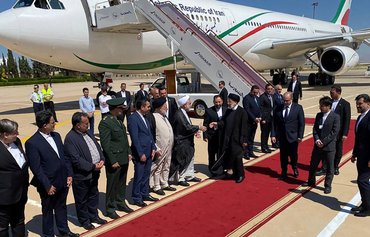

![A man sits at his money exchange stall in Fardus Square in central Baghdad. [Sabah Arar/AFP]](/cnmi_di/images/2017/01/06/6984-iraq-money-exchange-600_384.jpg)